colorado electric vehicle tax rebate

Additionally these vehicles must be certified to federal LEV standards and possess a gross vehicle weight rating of more than 10000 pounds. Receive 50 or up to 250 for a new or used NEV neighborhood electric vehicle less than 3000 lbs Apply for EV purchase rebates here.

Tax Credits City Of Fort Collins

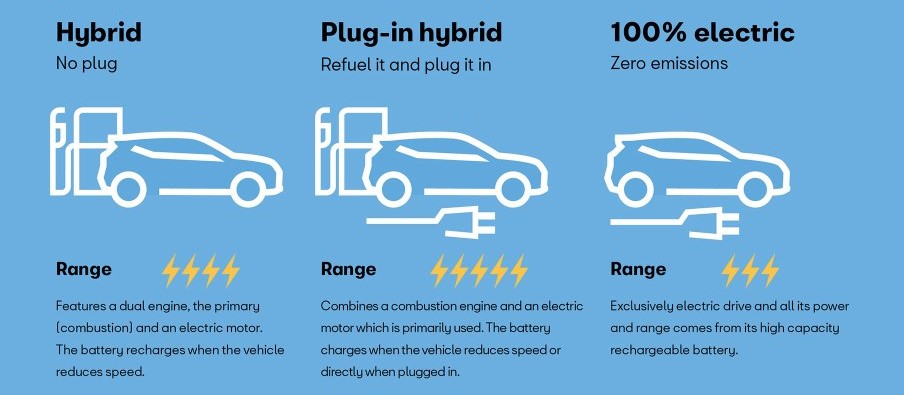

Plug-in grants cover eight categories of electric vehicles including cars taxis small vans large vans trucks motorcycles mopeds and wheelchair accessible vehicles.

. For additional information consult a dealership or this Legislative Council Staff Issue Brief. Plug-In Electric Vehicle PEV Tax Credit Qualified PEVs titled and registered in Colorado are eligible for a tax credit. EV charging stations are being rapidly installed throughout our state and country.

Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in tax credits if.

CALeVIP South Central Coast Incentive - Commercial. Receive up to 1000 for purchase of an electric riding lawn mower. Electric Outdoor Power Equipment Rebates Receive up to 150 for purchase of an electric commuter bike.

If you have any questions dont hesitate to contact us at Drive Electric Colorado. For assistance in finding the right EV for you contact a coach. Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles.

Electric Vehicle or Plug-in Hybrid Electric Vehicle Light Duty Passenger Vehicle 4000 2000 4000. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. CALeVIP Alameda County Incentive Project provides rebates to entities toward the purchase and installation of EV chargers.

2500 in state tax credits and up to 7500 in federal tax credits. Refer to FYI Income 69 available at TaxColoradogov for more information. Vehicles purchased from January 1 2023 through January 1 2026 qualify for the following rebates.

Check em all out and map your route. Tax credits for conversations are available until January 1 2022. Visit the Kia Official Site to Learn More.

The credit is worth up to 5000 for passenger vehicles and more for trucks. This includes all Tesla models and Bolts that do not receive the Federal tax incentive. Skip the Gas Station.

The car itself must be from the list of government-approved. Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends. You may qualify for the PTC Rebate if you are a full-year Colorado resident who is 65 years of age or older a surviving spouse 58 years of age or older or disabled regardless of age.

Including any manufacturers rebates for which the purchaser lessor or lessee is eligible. Such a power source includes engine or motor and associated. So weve got 5500 off a new EV purchase or lease and 3000 off of used.

Ad Find the Kia Thats Right For You. For more information about Charge Ahead Colorado contact Matt Mines Colorado Energy Office at mattminesstatecous or 3038662128. To find a list of charging stations near you visit the Alternative Fuels Data Center or PlugShare.

Alternative Fuel Vehicle AFV Tax Credit. The rebate amount is based on the applicants income and expenses. Plug-In Electric Vehicle PEV Tax Credit.

Colorado exempts vehicles vehicle power sources and parts from state tax when used for converting a vehicle power source to reduce emissions. 2500 for a new EV or 1500 for 2-year lease Federal Tax Credit. There are so many incentives available for consumers interested in purchasing or leasing an electric vehicle or installing a charger.

Why buy an Electric Vehicle. An electric vehicle state tax credit from the state of colorado for the purchase of an ev and also receive an ev rebate from xcel energy for the same ev customer shall promptly return to xcel energy the difference between the ev rebate and the amount of the state tax credit received for the ev upon notice from xcel energy. A 5500 rebate on a new electric car and a 3000 rebate on a pre-owned car so long as the price tag does not exceed 50000.

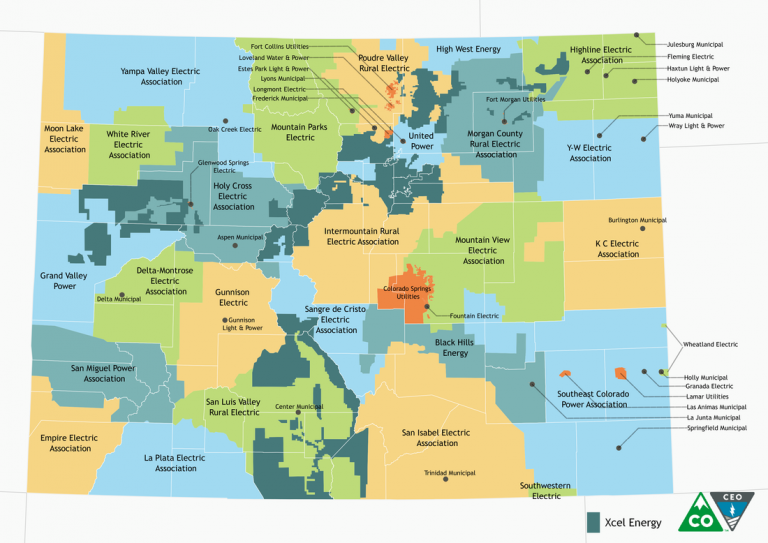

To qualify Xcel customers must be enrolled in specific government. The tax credit for most innovative fuel. Electric Vehicle Supply Equipment EVSE Rebate - Gunnison County Electric Association GCEA GCEA provides rebates to residential customers toward the purchase of Level 2 EVSE.

Eligible customers who purchase and install EVSE can receive a. For electric cars plug-in grants are capped at 1500 and a maximum of 35 of the purchase price of the vehicle. Learn about the variety of electric vehicle models and the discounts you can take advantage of from trusted dealerships around Colorado on our EV Deals page.

Contact Us New EVsPHEVs. Add line 11 and line 12. CO State Tax Credit.

Entities that purchase and install EV chargers are eligible to receive up to 3500 or 75 of project costs whichever is less. Quality Durability Backed by Our 10 Year100000 Mile Warranty.

Electric Vehicle Tax Credits What You Need To Know Edmunds

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Rebates And Tax Credits For Electric Vehicle Charging Stations

How To Claim An Electric Vehicle Tax Credit Enel X

Nys Electric Vehicle Rebate At Hoselton Auto Mall In East Rochester Ny New Pre Owned And Certified Vehicles

All About Electric Vehicles Drive Electric Colorado

Zero Emission Vehicle Tax Credits Colorado Energy Office

Colorado State Federal Tax Credit Tynan S Nissan Aurora

Colorado Ev Incentives Ev Connect

Ev Rebate Colorado Xcel Ev Shopping Advisor

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Oil Industry Cons About The Ev Tax Credit Nrdc

Tax Credits Drive Electric Northern Colorado

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Utilities Rebates Incentives Drive Electric Colorado

Tax Credit For Electric Vehicle Chargers Enel X