georgia property tax exemption for certain charities measure

What it does. GA Code 48-5-41 2014 a The following property shall be exempt from all ad.

Sales Taxes In The United States Wikipedia

Shall the act be approved which provides an exemption from ad valorem taxes for all real property owned by a purely public charity if such charity is exempt from taxation under.

. What does this measure do. The Athens-Clarke County Board of Tax. The Georgia Timber Equipment Exempt from Property Taxes Measure on the November 2022 ballot would change the states tax law so that starting Jan.

Additionally a corporation may be eligible for a local property tax. 4000 off county bond taxes. Under current state law family farms are exempt from paying certain property taxes on a wide range of farm equipment such as tractors combines balers sprayers and.

The Georgia Property Tax Exemptions Referendum also known as Referendum 1 was on the ballot in Georgia on November 4 1986 as a legislatively referred state statute. Types of Property Tax Exemptions in Georgia To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. How did this measure get on the ballot.

The measure would exempt from taxes property owned by charities for the purpose of building or repairing single-family homes to be financed by the charity and. Ballot language and constitutional changes This measure exempts. Taxpayer has burden of proving it qualifies for an exemption Much more than saying we qualify 24 Purely Public Charities Qualification Requirements 1 Owner must.

100 disabled persons of any age can apply for this exemption. The foundation applied for an exemption from property tax as an institution of purely public charity under OCGA. Path to the ballot The measure was sponsored by Republica See more.

An organization engaged primarily in charitable activities may be eligible for a local property tax exemption.

Employee Retention Credit Information Carr Riggs Ingram Cpas And Advisors

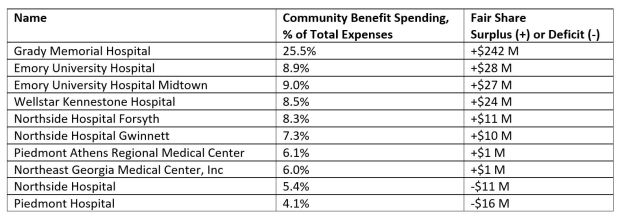

What A Controversial List Says About Nonprofit Hospitals Charity Record Georgia Health News

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Taxes In The United States Wikipedia

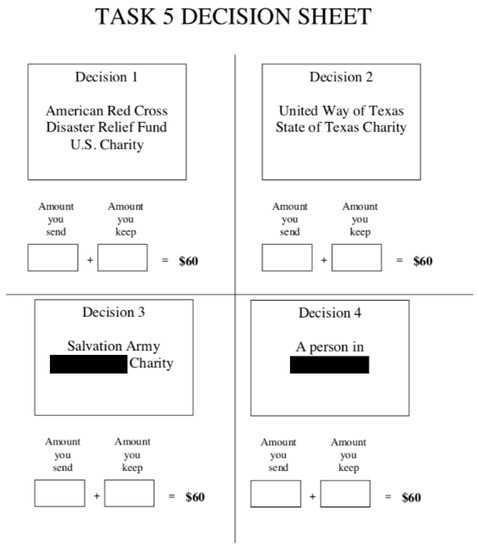

Games Free Full Text Charity Begins At Home A Lab In The Field Experiment On Charitable Giving Html

Learn More About Georgia Property Tax H R Block

Charitable Contributions Turbotax Tax Tips Videos

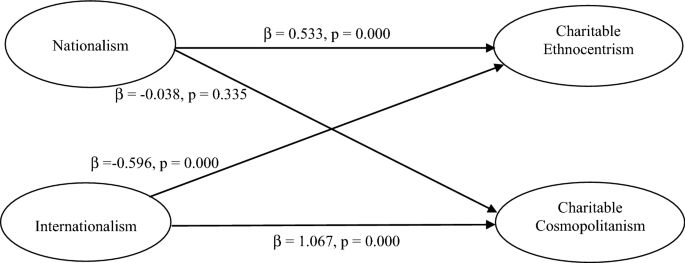

Does Charity Begin At Home National Identity And Donating To Domestic Versus International Charities Springerlink

Employees Look To Workplace Programs To Ease Charitable Giving

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Two Types Of Charitable Trusts You Should Know About Carr Riggs Ingram Cpas And Advisors

Georgia Referendum A Property Tax Exemption For Certain Charities Measure 2020 Ballotpedia

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

Charity Navigator Rating For Cdc Foundation

Guide To Nonprofit Governance 2019

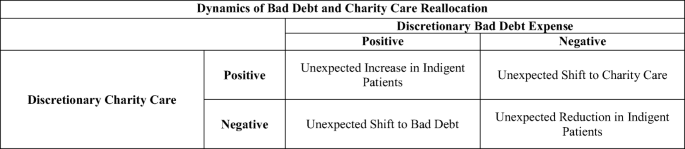

Strategic Reporting By Nonprofit Hospitals An Examination Of Bad Debt And Charity Care Springerlink

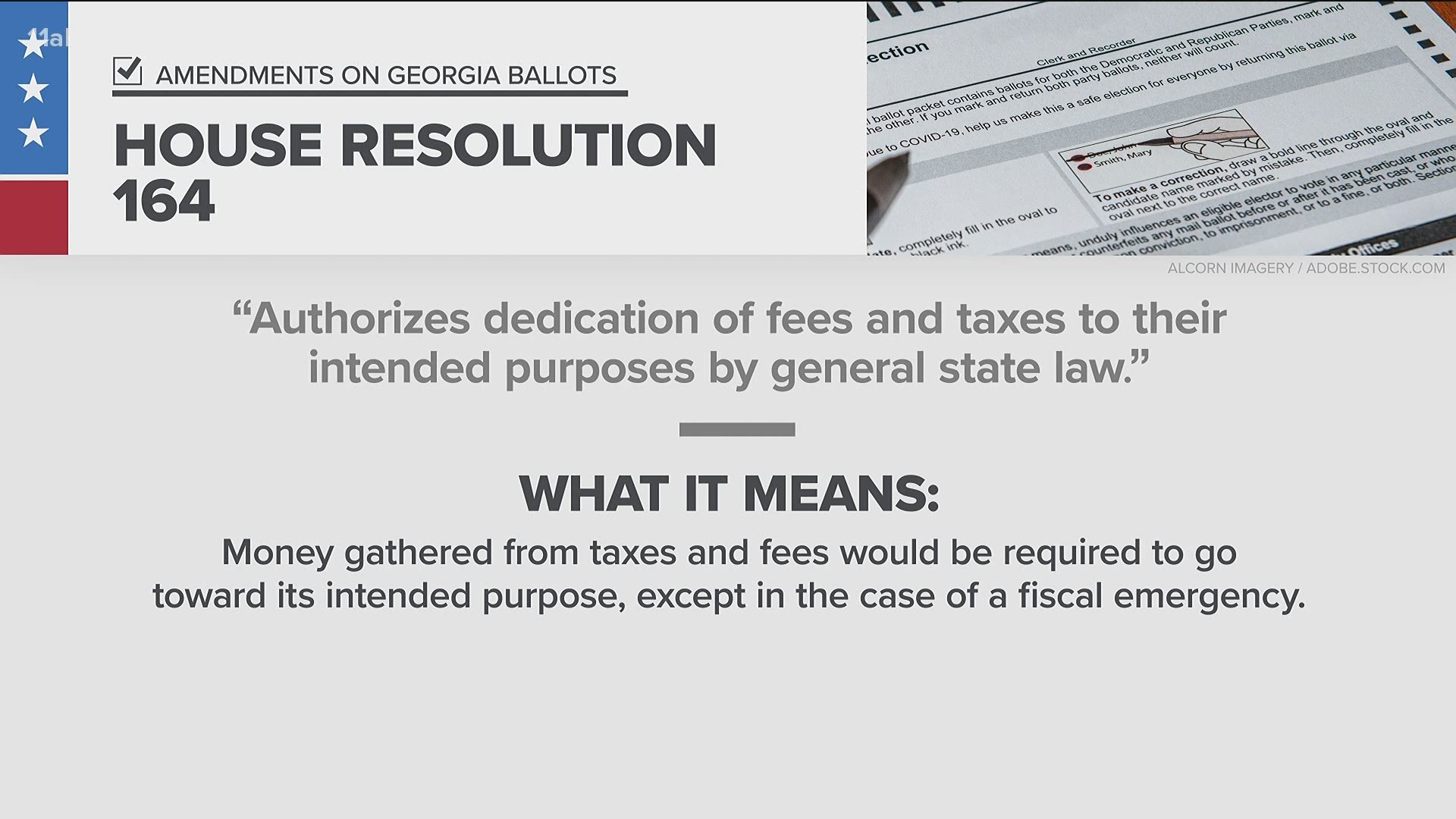

2020 Election What Amendments On The Georgia Ballot 11alive Com

2020 Election What Amendments On The Georgia Ballot 11alive Com

Are Religious Organizations Exempt From State Charitable Solicitation Registration